After a three-year rally, the financial markets have been down for seven straight days, marking their worst slide since the pandemic decline in March of 2020. (1) Monday’s market dip put the S&P 500 down over 10%, which is officially called a “correction” on Wall Street. (2)

The most likely cause for the stock market decline is that the Federal Reserve will begin raising interest rates in the spring, which could potentially slow the economy. (3)

Investors are understandably nervous about their investments and their purchasing power. If you are worried about your portfolio, you’re not alone. But during stock market volatility, it’s important to keep a level head to avoid financial mistakes.

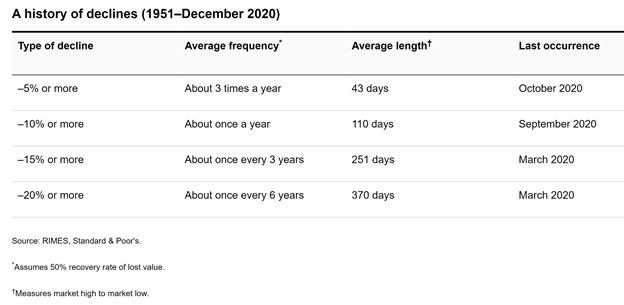

At times like these, it’s important to put current conditions into perspective. This is not the first time the market has taken a tumble and it won’t be the last. Declines in the Dow Jones Industrial Average are actually fairly regular events. In fact, drops of 10% or more happen about once a year on average: (4)

It’s important to remember that markets dislike uncertainty. Currently, there is a lot of uncertainty regarding the continued coronavirus pandemic, inflation, interest rate hikes, tensions between Russia and Ukraine, and earnings reports due out for several large technology companies.

With so much uncertainty, volatility right now is extreme. The VIX, or the market volatility index, is at the highest level in nearly a year. (5) As we get more information, it is likely that day-to-day market volatility will decrease.

There’s an old saying that the best thing to do when you meet a bear market is the same as if you were to meet a bear in the woods: play dead. While easier said than done, successful long-term investors know that it’s important to stay calm during a market correction. Adding additional cash to your accounts during a correction can be a nice opportunity to take advantage of the decline in stock prices and earn profits on a long term basis.

Market volatility has increased in recent years and the media can often make it seem like each episode is worse than the one before. In reality, volatility does not hurt investors, but selling when the market is down will lock in losses.

Fears about inflation, volatility, and market declines are stressful. However, it is important to keep in mind that while the stock market is down, your portfolio is made up of both stocks, bonds, and other assets that are designed to work together to accumulate wealth over the long term. It’s important to consider your specific portfolio, investment horizon, and circumstances when reflecting on economic events. If you have questions about your portfolio, get in touch with our office.

Now is a good time to take a look at all of your investment accounts, including your 401(k) to make sure it is well diversified. If you have not rebalanced your other investment accounts in the last year, get in touch with our office and we’ll take a look.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Whether you’re new to investing or an experienced investor, it’s helpful to consult with an objective third party. Human nature causes us all to act out of emotion when our accounts go down. As an independent firm, we put your best interests first. We seek to serve as a support system for our clients, helping them make informed financial decisions that aren’t driven solely by emotion.

If you have friends or family who need help with their investments, we are happy to offer a complimentary portfolio review and recommendations. We can discuss what is appropriate for their immediate needs and long-term objectives. Sometimes simply speaking with a financial advisor may help investors feel more confident and less concerned with the day-to-day market activity. Our team at Wealth Advocate Group is here to help. Reach out to us at Contact@Wadvocate.com or 440-505-5578 to schedule an introductory consultation.

David Thorne is CEO at Wealth Advocate Group, LLC, an independent, fee-based wealth management company based in Beachwood, OH. With over 25 years of experience, David specializes in working with executives, helping them create proactive strategies for incentive and non-qualified stock options, restricted stock (RSUs), and concentrated stock positions. David is known for delivering a high level of service to his clients through Wealth Advocate Group’s caring-first, relationship-based approach. Dave has a bachelor’s degree in finance and psychology from Kent State University and is a CERTIFIED FINANCIAL PLANNER™ professional. He has also been a featured guest speaker for several financial service associations, focusing on executive stock option planning and risk management. When he’s not working, you can find David spending time with his wife, Tiffany, and their three adult daughters. He loves participating in all types of fitness activities, including snowboarding, mountain biking, and hiking with his dog. To learn more about David, connect with him on LinkedIn.

Economic Forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult me prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

________________

(1) https://www.cnbc.com/2022/01/

(2) https://www.forbes.com/

(3) https://abcnews.go.com/

(4) https://www.capitalgroup.com/

(5) https://seekingalpha.com/news/