It used to be that 4% was a safe withdrawal rate. If you only withdrew 4% of your retirement savings a year, it would be enough to last at least 30 years. This meant that if you needed $120,000 a year to live comfortably in retirement, you could save $3 million and be set for life.

But unfortunately, figuring out how much money you need in retirement isn’t that easy. It’s not a one-size-fits-all formula. Not only do you need enough money to cover your essential expenses in retirement, you also want to retire comfortably enough to do many of the things you’ve been dreaming of.

Let’s take a closer look at some of the factors to consider when deciding when to retire and how much to save.

When you’re in the accumulation phase of retirement planning, you’re not withdrawing from your accounts just yet; you’re only adding money. During this phase, the sequence of market returns doesn’t matter as much. You can have a mix of good years and bad years over a 10- or 15-year period and your returns will be the same overall because you didn’t withdraw any money during that time.

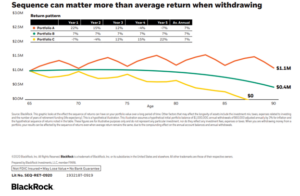

But when you finally retire and start taking withdrawals, sequence of returns begins to matter. If you experience a few bad years at the beginning of retirement, it could greatly reduce how long your money lasts. Here’s what it looks like. (1)

In this chart, you can see that Portfolio A, B, and C all start with the same $1 million balance, and withdraw the same $60,000 a year adjusted 3% annually for inflation. However, each portfolio experiences a different mix of high and low returns over the years. Portfolio A has positive returns in the beginning and ends up with $1.1 million left in the bank at age 90. On the other hand, Portfolio C has a few negative returns in the beginning and ends up running out of money around age 87.

Depending on your overall expenses in retirement, this math could work out the same way regardless of whether you have a $1 million nest egg or a $5 million nest egg.

The moral of the story? Even if you have a rough idea of how much you need to retire comfortably, you could still run out of money prematurely if you retire in a bear market and don’t have a proper cash flow plan in place. That’s why it’s critical to meet with a financial advisor who can stress test your portfolio and run various what-if scenarios to help guide your retirement assets so that they can last even through the most turbulent of times.

Have you thought about where you’ll live once you retire? Will you stay in your current city or relocate somewhere new and exciting? The cost of living in Beachwood, Ohio, is about 6.3% higher than the U.S. average and around 23% higher than other cities in Ohio. (2) Retire to Honolulu, Hawaii, and your cost of living would be about 77% higher than the U.S. and 70% higher than Beachwood. (3)

Where you choose to live in retirement matters. It plays a major role in how much money you’ll need to live comfortably. That’s not to say you should move to an area with a lower cost of living as soon as you retire—you also need to factor in which location will make you happy and keep you active. But if you choose an area with a higher cost of living, it’s important to factor these costs into your retirement planning.

Inflation is known as the silent killer in retirement because it creeps up on you. You never really see it coming until you look back and realize that a $4 loaf of bread used to only cost $0.50. And with the rampant inflation we’ve seen lately, our purchasing power has been diminished by quite a bit. While we don’t know how long the current inflation increase will last, we always have to factor inflation into our retirement plans.

Based on the normal average annual inflation rate of 2%, (4) the $150,000 a year you live on now will be the equivalent of $223,000 in 20 years, and $272,000 in 30 years. (5)

As you continue to save for retirement, keep in mind that you’re saving for today’s income and expenses as well as your future inflated income and expenses. Be realistic about how much you need to save and talk with a financial advisor about ways you can preserve your nest egg from the eroding power of inflation.

If only figuring out how much you need for a comfortable retirement were as simple as a one-and-done formula (or a quick Google search!). On the contrary, it requires a deep dive into your financial situation, family history, and goals.

At Wealth Advocate Group, we build a custom-tailored retirement cash flow model for each client and then stress test it to evaluate the risks of low interest rates, increasing inflation, and variable market returns. We incorporate your unique situation and family needs with the goal that your money can last as long as you do.

If you’d like help figuring out when you can retire and how much you’ll need to do it, call 440-505-5751 or email jcohen@Wadvocate.com to schedule an appointment.

Jason Cohen is Chief Operating Officer and wealth advisor at Wealth Advocate Group, LLC, an independent, fee-based wealth management company. Jason has 15 years of experience and spends his days managing firm operations, including portfolio trading and analysis, training of new advisors, financial plan production, and client relationship management. Jason specializes in serving real estate professionals and other independent contractor business owners, helping them navigate their unique financial challenges, such as unpredictable cash flow and tax issues, so they can pursue financial independence. Jason has a bachelor’s degree in public management from Indiana University and is a CERTIFIED FINANCIAL PLANNER® professional and believes that everyone should have access to comprehensive financial planning. He is passionate about doing his best for his clients and setting others up for success. Outside of the office, you can find Jason staying active in a variety of sports and spending time with friends and family. Learn more about Jason by connecting with him on LinkedIn.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

_____________

(1) https://www.blackrock.com/cl/literature/investor-education/sequence-of-returns-one-pager-va-us.pdf

(2) https://www.bestplaces.net/cost_of_living/city/ohio/beachwood

(3) https://www.bestplaces.net/cost_of_living/city/hawaii/honolulu

(4) https://www.thebalance.com/u-s-inflation-rate-history-by-year-and-forecast-3306093

(5) https://smartasset.com/investing/inflation-calculator